Press Releases

NEW YORK, June 18, 2020 /PRNewswire/ -- Enterprises around the world are quickly learning how to adapt to a new normal in the wake of disruptions caused by COVID-19, according to a recent survey conducted by 451 Research, the emerging technology research unit of S&P Global Market Intelligence. Close to 80% of organizations surveyed said they have implemented or expanded universal work-from-home policies as a result of COVID-19, while 67% expect these policies to remain in place either permanently or for the long-term.

451 Research's Digital Pulse COVID-19 Flash Survey features responses collected between May 29 to June 11 from approximately 575 IT decision-makers across a range of industries. The new study sheds light on the future of work and highlights some of the enterprise-wide changes that companies actually experienced or implemented. Topics covered include operational impacts, changes to budgets, spending and pricing, adaptation of IT initiatives, and new findings on how enterprises plan to return to the office.

"As organizations are heading back to the office in the wake of COVID-19, it is important to quantify what changes materialized during these past few months as a potential indication for the future of work," said Liam Eagle, Head of Voice of the Enterprise Research at 451 Research, part of S&P Global Market Intelligence. "Leveraging timely data from our flash survey capabilities can help us better understand these changes and overall market sentiment, while enabling organizations to make informed business decisions during times of uncertainty."

Highlights from the survey include:

- Firms have implemented several travel and event-related measures that change office life. In addition to the 80% of organizations that said they have employed expanded or universal work-from-home policies, 85% have implemented travel limitations and the same percentage limited or banned face-to-face meetings. 71% of respondents also said they are converting hosted events into virtual ones and 37% have expanded employee leave rules among other changes.

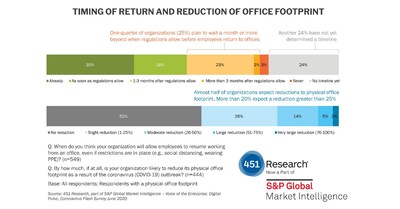

- Companies are in no rush to head back to workplaces. Although close to 19% of organizations intend to have employees return to offices as soon as local regulations allow, 25% will wait a month or more while another 24% have not yet determined any timeline.

- A reduction in office space is expected. While companies are hesitating to head back to physical office spaces, 47% of respondents say they are likely to reduce its physical office footprint because of the COVID-19 outbreak. More than 20% expect it to reduce by more than 25%.

- Altered working conditions are presumed to be long-term or permanent. About 20% of respondents say their organization is planning to operate under alternate conditions such as remote working, wearing protective gear, and social distancing through 2021 and beyond. 14% responded that conditions have been altered permanently, while 18% have yet to establish a plan.

- Travel will remain scarce, even in Q4 2020. Compared to the last quarter of 2019, a third of organizations (34%) expect work travel to be reduced by 80% or more in the fourth quarter of this year; yet, a large cohort of respondents (21%) say they don't know how much travel will resume during this period.

- Social distancing serves as a barrier to returning to office life. 79% of organizations agree that social distancing will be the biggest challenge in resuming normal operations.

- Organizations are more likely to be spending more on IT resources with notable increases to security spending. Compared to March, increased information security spending grew more common (from 15% to 28% of businesses) and organizations are spending more on communication and collaboration technologies (50%), employee devices and services (43%), information security tools (42%) and network capacity (38%).

- Many businesses are seeking flexible terms from suppliers. More than half (56%) of organizations agreed they were offering to adjust the terms of leases, licenses or contracts for their customers. Similarly, 42% of organizations said they were expecting or asking IT vendors to adjust pricing, payment terms or payment models.

The latest survey is a follow-up to the COVID-19 Flash Survey published in March, which assessed the difficulties enterprises expected to face in light of the global COVID-19 outbreak.

To access the full report, please contact pressinquiries.mi@spglobal.com.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we know that not all information is important—some of it is vital. We integrate financial and industry data, research and news into tools that help clients track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities globally can gain the intelligence essential to making business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). For more information, visit www.spglobal.com.

Media Contact

Amanda Oey

S&P Global Market Intelligence

+1 212-438-1904

amanda.oey@spglobal.com

SOURCE S&P Global Market Intelligence