Press Releases

HONG KONG, Aug. 13, 2020 /PRNewswire/ -- The COVID-19 pandemic accelerated the adoption of existing digital trends in China, such as increased over-the-top ("OTT") video viewing, active social media and e-commerce engagement, and high interest in 5G technologies, according to the latest survey conducted by Kagan, a media research group within S&P Global Market Intelligence.

Fielded in June this year, Kagan's 2020 Asia Consumer Insights Survey features responses from more than 1,000 adult internet-users in China on the use of internet-connected devices, online digital entertainment services and related customer behaviour.

"COVID-19 will continue to drive the rapid adoption of digital technologies in China," said Julber Osio, Associate Research Analyst for Kagan, S&P Global Market Intelligence. "Digital transformation will undoubtedly play an important role throughout the pandemic outbreak and beyond the recovery. More companies are aligning and shifting their digital efforts towards growing customer expectations."

Highlights from the 2020 Asia Consumer Insights Survey include:

Entertainment

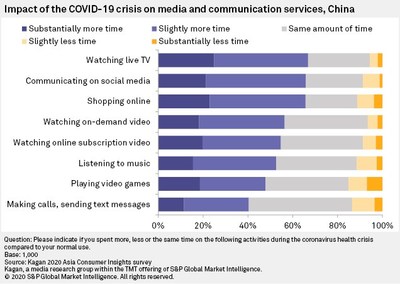

- Live TV, video watching increased: 67% of adult internet users in China reported spending more time watching live TV during the COVID-19 crisis while 56% spent more time watching OTT video.

- iQiyi and Tencent Video remained dominant in OTT video, but smaller OTT players like UUSee were the biggest winners with a higher proportion of new users during and after COVID-19 restrictions.

- People are not eager to return to cinemas as only 16% of respondents expressed willingness to spend again on movie theatres immediately after lifting of COVID-19 restrictions.

Social Media, Super Apps

- Social media use surged: 66% of adult internet users in China reported spending more time in social media.

- WeChat (97%) and Alipay (95%) were the most popular "super apps," or one-stop apps that offer multiple services through mini-programs or mini-apps.

- Mobile payments emerged as the most popular activity among super app users (87%), followed by booking services such as grooming, pet services, medical appointment, etc. (78%).

E-commerce

- 66% of respondents reported that they spent more time shopping online.

- 68% of respondents used their smartphones for online shopping in the past three months, which was a big jump from just 55% in 2018.

Connected Devices

- IPTV and Mobile TV subscribers are increasing, with 45% and 33% of respondents indicating subscribing to the services, respectively.

- Android smartphone users on the rise and reached 86%, while Apple iPhone ownership slightly fell to 34%.

5G and other new technologies

- 93% of wired internet users in China expressed interest in replacing their home internet service with wireless 5G.

- Among Internet of Things ("IoT") applications that we surveyed, home security system got the highest net interest rate (89%). Driverless or autonomous cars got the least reported ownership (2%) but net interest remains high (81%).

- 76% of respondents expressed concerns about their personal data being collected and compromised through IoT connections.

To access additional survey findings, please contact Vivian.Liu@spglobal.com.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we know that not all information is important—some of it is vital. We integrate financial and industry data, research and news into tools that help clients track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities globally can gain the intelligence essential to making business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). For more information, visit www.spglobal.com.

Media Contact

Vivian Liu

S&P Global | Market Intelligence

+852 9179 1132

Vivian.Liu@spglobal.com

SOURCE S&P Global