Press Releases

NEW YORK, Dec. 13, 2021 /PRNewswire/ -- Analysts at S&P Global Platts, the leading independent provider of information, analysis and benchmark prices for the commodities and energy markets, today released their 2022 energy outlook.

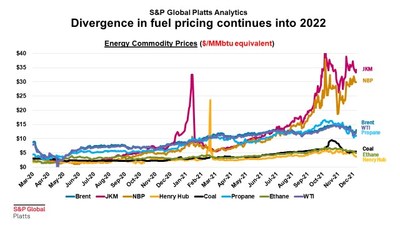

Jennifer Van Dinter, head of integrated analytics, S&P Global Platts, said: "Energy markets have been on perhaps the biggest rollercoaster ride in history over the past two years, seeing both negative prices and record prices. As we enter 2022, most commodity markets remain tight, as supply has struggled to match the rebound in demand during 2021, resulting in a drawdown of inventories and much stronger pricing."

2022 Integrated Energy Outlook: When will the bubble burst?

In 2022, S&P Global Platts Analytics expects supply to catch up and even exceed demand growth highlighted by an increase in LNG exports, a rebound in US shale oil, gas and NGLs and the return of investment in non-OPEC production. Fears about the impact of new coronavirus variants, like omicron, on demand will add to volatility but are likely overblown. As an increasing amount of the world's population with the highest GDP/capita become vaccinated, the potential magnitude of the impact on economic activity and demand will shrink. Aviation sector demand will likely be the most sensitive if infections become more severe but impacting a smaller number of flights as outbreaks become increasingly localized.

Prices will begin to normalize as inventories recover. Amid this process, we expect to see a greater divergence between oil and gas prices as oil starts to rebalance in the first quarter, while gas markets will remain tighter longer. Natural gas markets are vulnerable to price shocks if we experience the below-average temperatures we experienced last winter, particularly outside of North America. The divergence between oil and gas prices will see increased oil light-end products into traditional gas markets, tightening LPG supply, and by extension gasoline. At the same time, we expect strong demand growth for diesel to fuel commercial transport as supply chains debottleneck, as well as the gradual ramp up of aviation activity. While we expect stocks to recover during the year, the lack of spare capacity both in gas and oil, will leave the market vulnerable to disruption. This will be all the more difficult in light of a handful of geopolitical risks looming in key areas of supply: Iran, Libya, and Nord Stream 2. Any disruption in global supply chains will also have outsized influence on prices. While oil prices have recently corrected downward, the key test will come in the third quarter as summer demand challenges supply resilience – the absence of an Iran deal could leave the market vulnerable to breaking $100 per barrel ($/b) if combined with any other disruptive event.

Despite the increased rhetoric and focus on energy transition demand for all fossil fuels will increase in 2022, requiring more fossil fuel supply. Even though some companies and investors are looking to divest from fossil fuels, we see healthy levels of investment in 2022 and beyond prompting an easing of energy prices. Expect a ripple effect into other commodity sectors, including metals and agriculture, impacting the current commodity bubble. Even after the bubble pops, energy markets will only become more intertwined. Fundamentals and data will matter more than ever, requiring a steady, holistic perspective across the breadth of the energy market. Platts Analytics will continue to strive to bring clarity to the energy markets, enabling our customers to act with conviction in 2022.

TOP TEN KEY THEMES TO THE 2022 ENERGY OUTLOOK: S&P GLOBAL PLATTS ANALYTICS:

- As the first quarter goes, so goes the year. Prices across all commodity markets will by and large end 2021 at elevated levels, even if some will have slipped from peaks achieved earlier in the year. Generally, low inventories and fears of supply inadequacy over the Northern Hemisphere winter expose prices to extensive upside risk in the first quarter, particularly natural gas prices. If winter weather proves to be colder than normal in key markets (China, Japan, Europe), inventories will draw further, and prices will spike even higher. La Niña conditions make cold weather more likely in these markets. Conversely, a mild winter will ease pressure, allowing prices to normalise faster. Key geopolitical risks, such as the Iran Deal and Nord Stream 2, will have notable signposts in the first quarter, and even if they are not fully resolved in by the end of March, their status will have a large bearing on how balances and prices shape up over the rest of the year.

- After 2021 focused on energy demand recovery, 2022 will focus on whether supply can catch up. In virtually all energy commodity markets, demand rebounded more than supply in 2021, resulting in a drawdown of inventories and much higher pricing. In 2022, energy supply will grow faster, not only to catch up to 2021 demand, but also to cover additional demand growth in 2022 and to rebuild depleted inventories. While this will be a difficult lift for the supply side under normal circumstances, several key commodities and markets face considerable geopolitical risks to supply growth. While the demand side is certainly not without risk, particularly with the new COVID variant, any disruption in global supply chains will have outsized influences on prices.

- Deal or no deal: Iran is the key Iran will significantly influence oil balances in 2022, and by extension, oil prices. We assume a framework US-Iran nuclear deal will be reached in Q1, with full sanctions relief by April, facilitating 1.4 million barrels per day (b/d) of Iranian oil supply growth by the end-2022. But risks that no deal can be reached are high. Even with Iranian barrels coming back, oil markets will need more supply from the rest of OPEC by mid-year. If Iranian oil does not come back to the market, OPEC capacity will be pushed to the limit. Tensions in the Middle East will only worsen with a defiant Iran. The lack of an Iran deal, if coupled with supply interruptions elsewhere, could see oil prices test $100/b.

- New COVID variants will continue to impact oil demand but vaccinations will blunt the impact and release some pent-up demand. The rise of the omicron variant in November has raised fears that the recovery in oil demand will be derailed by renewed restrictions to mobility. While S&P Global Platts Analytics expects that new variants and localized outbreaks will occur in 2022, we do not expect the same magnitude of restrictions on mobility, particularly international air travel, that occurred in 2020 and early 2021. We project that oil demand will increase by over 4 million b/d in 2022. Even in a case where COVID proves to be more disruptive than expected, oil demand will still increase by almost 3 million b/d at a minimum, as vaccinations continue to build globally, and importantly, in countries with high GDP per capita. Oil demand growth could exceed 6 million b/d if we revert to normal more quickly. The strength in demand will push refinery runs and utilization rates (even including increased refining capacity) close to their historical ranges, improving margins.

- Global natural gas prices will hinge on the Nord Stream 2 pipeline and Russia's gas strategy. Currently, Russia is the primary source of the world's spare capacity and delivering that supply to markets eager to meet demand and rebuild storage will dominate balances and prices in 2022. The delayed Nord Stream 2 pipeline is essential to boosting Russian gas supply into Europe as Russia is shifting away from Ukraine transit and Electronic Sales Platform (ESP) sales. Despite the fact that Europe is desperate for gas supply, regulators appear to be in no rush to sign off on Nord Stream 2. While S&P Global Platts Analytics expects the pipeline will begin operations in June, further delays would cause European buyers to scramble for alternative gas supply, boosting not only European gas prices, but global LNG prices. Even US prices would get an uplift from this, as US LNG exports will ramp up further in 2022.

- Three to five North American LNG liquefaction projects will make final investment decisions after a two-year hiatus. Strength in global gas prices have bolstered the value proposition of incremental LNG liquefaction projects in North America, particularly in Western Canada and the US Gulf Coast, breathing new life into the prospect of an additional wave of North American LNG. Despite the prospect of slower LNG demand growth in Asia over the next few years, developers have been able to line up buyers and equity investors for potential capacity, which increases the likelihood these projects will come to fruition.

- India to surpass China as world's largest importer of thermal coal as China drives for self-sufficiency. Global coal demand is expected to increase again in 2022 as developing markets, China and India in particular, will need additional energy supply from coal to meet incremental energy demand growth. Despite higher domestic consumption, China's thermal coal imports are expected to decline in 2022, as domestic production will increase by an even larger extent, as policymakers press for more self-sufficiency. At the same time, the import constraints India encountered in 2021, such as record high coal prices and freight rates, will be less severe in 2022, allowing imports to increase strongly to meet higher domestic demand and rebuild depleted stockpiles.

- New planting seasons offer new beginnings for agricultural commodities, but tight fertilizer supply and La Niña skew risks to the upside. Demand for food and renewable fuels will continue to increase, which will keep prices well supported and challenge biofuels and renewable fuels economics. Tight fertilizer supply, in the wake of turndowns of production facilities due to high natural gas prices in 2021, coupled with the rise of potentially dry conditions in Brazil from La Niña, are key supply constraints for agriculture and biofuels markets. The fate of Brazil's second season (safrinha) corn crop will have direct and large implications on prices and demand for US exports. Renewable diesel demand for US soy oil will gain again in 2022, while Brazilian production will cover most of China's small increase in demand.

- CO2 emissions to hit record high in 2022 despite greater focus on climate putting emissions policy on the ballot in key markets. Despite the focus on emissions reductions and a lengthening list of countries that have made net zero targets, we expect that CO2 emissions from energy combustion will increase by 2.5% in 2022 to new record levels, as some economies fully recover while others push for growth. While leaders at COP26 pledged to strengthen 2030 emissions targets by the end of 2022 rather than waiting for the formal "stock taking" process, there are significant risks to domestic environmental policy agendas from elections in 2022. Midterm elections in the US could derail the Biden Administration's environmental agenda, while Australia's opposition party is looking to oust the more conservative government by making stronger environmental targets a priority. These elections are reminders that "all politics are local" and the fates of global agreements are often determined by domestic elections, public sentiment, and policy shifts.

- Strong power prices boost renewables installations, but can they deliver with rising input costs and policy risks looming? Strong power prices have pushed renewable power margins to historically high levels and boosted prospects for faster installation growth in 2022. This is ironic since the underperformance of renewables was a key factor behind the surge in global power prices in the first place. Despite a ~10% increase in commissioning costs due to historically high raw materials prices and labor issues, S&P Global Platts Analytics expects solar PV additions will increase by 4% in 2022, while onshore wind installations increase by 1%. Capacity growth is predicted to decline for offshore wind, which will contract by 25% in 2022 after a strong 2021 due to the phase out of subsidies in China. The world will need to develop policies that balance the need to add zero carbon electricity supply with the cost of the dispatchability/availability of oftentimes intermittent renewable power with storage options.

Dan Klein, Head of Energy Pathways, Analytics, S&P Global Platts, said: "2021 was a clear example that recalibrating from such disruptive events like COVID-19 are often multi-year exercises. While recalibration will continue in 2022, it is likely that not all energy markets will be back to normal by the end of the year, particularly as the needs of the energy transition will require further disruption to business as usual."

About S&P Global Platts

At S&P Global Platts, we provide the insights; you make better informed trading and business decisions with confidence. We're the leading independent provider of information and benchmark prices for the commodities and energy markets. Customers in over 150 countries look to our expertise in news, pricing and analytics to deliver greater transparency and efficiency to markets. S&P Global Platts coverage includes oil and gas, power, petrochemicals, metals, agriculture and shipping.

S&P Global Platts is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for companies, governments and individuals to make decisions with confidence. For more information, visit http://spglobal.com/platts.

SOURCE S&P Global Platts