Press Releases

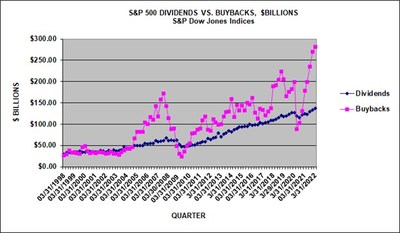

S&P 500 Q1 2022 buybacks were $281.0 billion, up 4.0% from Q4 2021's record of $270.1 billion; the 12-month March 2022 expenditure of $985 billion set a record, up 11.7% from 2021's record of $882 billion and up 97.2% from the 12-month March 2021's $499 billion

NEW YORK, June 16, 2022 /PRNewswire/ -- S&P Dow Jones Indices ("S&P DJI") announced today preliminary S&P 500® stock buybacks, or share repurchases, data for Q1 2022.

Historical data on S&P 500 buybacks are available at www.spdji.com/indices/equity/sp-500.

Key Takeaways:

- Q1 2022 share repurchases were a record $281.0 billion, up 4.0% from Q4 2021's record $270.1 billion expenditure and up 57.8% from March 2021's $178.1 billion.

- 374 companies reported buybacks of at least $5 million for the quarter, up from 325 in Q4 2021 and up from 335 in Q1 2021; 395 companies did some buybacks for the quarter, up from 383 in Q4 2021 and up from 370 in Q1 2021; 432 companies did some buybacks for the 12-months ending March 2022, up from 416 in the prior period.

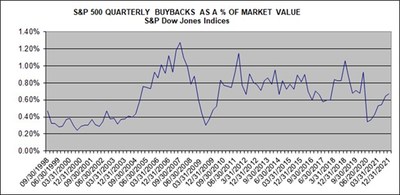

- Buybacks remained top heavy but declined significantly with the top 20 companies accounting for 42.1% of Q1 2022 buybacks, down from Q4 2021's 51.8%, down from the dominating 87.2% in Q2 2020, and down from the pre-COVID historical average of 44.5%.

- For the 12-months ending March 2022, buybacks were a record $984.6 billion, a 97.2% increase from the $499.2 billion spent in the March 2021 time period.

- 17.6% of companies reduced share counts used for earnings-per-share (EPS) by at least 4% year-over-year, up from Q4 2021's 14.9% and Q1 2021's 5.8%, but were still significantly down from the Q1 2019 rate of 24.9%.

- S&P 500 Q1 2022 dividends increased 2.8% to a record $137.6 billion from Q4 2021's $133.9 billion and were 11.1% greater than the $123.9 billion in Q1 2021. For the 12-months ending March 2022, dividends were a record $524.9 billion, up 9.3% on an aggregate basis from the 12-month's March 2021's $480.1 billion.

- Total shareholder return of buybacks and dividends was a record $418.6 billion in Q1 2022, up 3.6% from Q4 2021's $404.0 billion and up 38.6% from Q1 2021's $302.0 billion.

- Total shareholder return for the 12-months ending March 2022 increased to a record $1.510 trillion from the March 2021 $0.979 trillion.

- Buybacks are expected to continue at a higher level for Q2 2022, even as prices have declined, as reduced prices will increase the number of shares purchased and lift EPS due to share reduction.

"Companies continued their record-breaking buyback and dividend expenditures in Q1 2022, even as prices declined and market volatility and uncertainty increased," said Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices. "The record expenditures led to 17.6% of the companies in the S&P 500 increasing their earnings-per-share by at least 4% thanks to their newly lowered share count, up from the 5.8% in Q1 2021. While the EPS uplift remained well below the 24.9% rate of Q1 2019, the direction remained consistent, with declared new programs setting the stage for increased buying throughout 2022.

Outlook for Q2 2022:

Silverblatt added, "Companies are expected to maintain their buyback activities for Q2 through the current price downturn. This means companies will be getting more shares for their expenditures and reducing share counts even further, resulting in higher EPS. Operating earnings, which had set a record in Q4 2021, declined an estimated 13% in Q1 2022, but are expected to rebound in Q2 2022, with more issues benefiting from lower share counts and therefore adding stronger tailwinds to their EPS."

"Beyond Q2, at the minimum, companies are expected to cover exercised options, with stronger-cash-flow issues continuing to reduce shares. Given the strong base buying, expected earnings, even with the current level of inflation, a consumer spending slowdown and lower margins, buybacks could easily set another record in 2022."

Silverblatt noted that, "the 12-month March 2022 buyback record of $984.6 billion, which is expected to surpass the $1 trillion mark for the first time for June 2022 is a Washington headline in the waiting."

Q1 2022 GICS® Sector Analysis:

Information Technology continued to lead in buybacks, even as its percentage of buybacks declined. In Q1 2022, IT's share declined to 25.5% of all S&P 500 buybacks compared to Q4 2021's 27.7% and Q1 2021's 31.6%, as expenditures decreased (4.4%) to $71.6 billion from the prior quarter's $74.9 billion and were 27.0% higher than the Q1 2021 expenditure of $56.4 billion. For the 12-months ending March 2022, the sector spent $275.3 billion, representing 28.0% of all S&P buybacks, up from 12-month 2021's $199.1 billion, which represented 39.9% of all buybacks. For the 10-years, the sector spent $1.76 trillion, representing 28.5% of the expenditures.

Health Care buybacks increased 88.3%, spending $41.1 billion in Q1 2022 representing 14.6% of all buybacks, up from the Q4 2021 $21.8 billion, which accounted for 8.1% of the buybacks.

Financial buybacks increased 6.2% to $54.7 billion, representing 19.5% of the buybacks, from the Q4 2021 $51.5 billion, which represented 19.1% of all buybacks. The 12-month buybacks of $209.9 billion were 202% higher than the 12-month March 2021 buybacks of $69.4 billion, when the Fed limited buybacks.

Energy buybacks increased by 12.3% for the quarter, to $8.6 billion, from the prior quarter's $7.6 billion and up 1,654% from the Q1 2021 $0.5 billion. For the 12-months, buybacks were $20.8 billion compared to the prior period's $0.9 billion, a 2,092% increase.

Communication Services buybacks decreased by 21.3%, to $34.1 billion, from the prior quarter's $43.3 billion and up 56.4% from the Q1 2021 $21.8 billion. As a percentage of all buybacks, the sector decreased to 12.1% of all buybacks from the prior quarter's 16.0%, and the Q1 2021 12.2%.

Issues:

The five issues with the highest total buybacks for Q1 2022 are:

- Apple (AAPL) continued to be the poster child for buybacks as it again spent the most of any issue, with the Q1 2022 expenditure ranked fifth highest in S&P 500 history. For the quarter, the company spent $23.0 billion, down 1.7% from Q4 2021's $23.4 billion. Apple holds 18 of the top 20 record quarters (Meta Platforms holds #9 and QUALCOM holds #10). For the 12-months ending March 2022, Apple spent $92.4 billion on buybacks, up from the prior 12-month's $89.7 billion. Over the five-year period, they have spent $375.8 billion and $533.3 billion over the ten-year period.

- Alphabet (GOOG/L) was next: $13.3 billion for Q1 2022, down from $13.5 billion in Q4 2021; the 12-month March 2022 expenditure was $52.2 billion versus the 12-month March 2021 expenditure of $40.0 billion.

- Meta Platforms (META): $10.4 billion for Q1 20221, down from $21.6 billion in Q4 2021; the 12-month March 2022 expenditure was $55.5 billion versus $19.2 billion.

- Microsoft (MSFT): $8.8 billion for Q1 2022, up from $7.4 billion in Q4 2021; the 12-month March 2022 expenditure was $31.1 billion versus $27.4 billion.

- S&P Global (SPGI): $7.1 billion for Q1 2022, up from $0.002 billion in Q4 2021; the 12-month March 2022 expenditure was $7.1 billion versus $0.06 billion.

For more information about S&P Dow Jones Indices, please visit www.spdji.com.

S&P Dow Jones Indices | ||||||||

S&P 500, $ U.S. BILLIONS | (preliminary in bold) | |||||||

PERIOD | MARKET | OPERATING | AS REPORTED | DIVIDEND & | ||||

VALUE | EARNINGS | EARNINGS | DIVIDENDS | BUYBACKS | DIVIDEND | BUYBACK | BUYBACK | |

$ BILLIONS | $ BILLIONS | $ BILLIONS | $ BILLIONS | $ BILLIONS | YIELD | YIELD | YIELD | |

12 Mo Mar,'22 | $38,288 | $1,778.88 | $1,674.81 | $524.92 | $984.60 | 1.37 % | 2.57 % | 3.94 % |

12 Mo Mar,'21 | $33,619 | $1,258.59 | $1,074.57 | $480.11 | $499.17 | 1.43 % | 1.48 % | 2.91 % |

2021 | $40,356 | $1,738.62 | $1,652.78 | $511.23 | $881.72 | 1.27 % | 2.18 % | 3.45 % |

2020 | $31,659 | $1,019.04 | $784.21 | $483.18 | $519.76 | 1.53 % | 1.64 % | 3.17 % |

2019 | $26,760 | $1,304.76 | $1,158.22 | $485.48 | $728.74 | 1.81 % | 2.72 % | 4.54 % |

2018 | $21,027 | $1,281.66 | $1,119.43 | $456.31 | $806.41 | 2.17 % | 3.84 % | 6.01 % |

3/31/2022 | $38,288 | $417.33 | $388.42 | $137.60 | $281.01 | 1.37 % | 2.57 % | 3.94 % |

12/31/2022 | $40,356 | $456.22 | $434.29 | $133.90 | $270.10 | 1.27 % | 2.18 % | 3.45 % |

9/30/2021 | $36,538 | $441.26 | $420.64 | $130.04 | $234.64 | 1.37 % | 2.03 % | 3.40 % |

6/30/2021 | $36,325 | $439.95 | $409.02 | $123.38 | $198.84 | 1.33 % | 1.68 % | 3.01 % |

3/31/2021 | $33,619 | $401.19 | $388.84 | $123.91 | $178.13 | 1.43 % | 1.48 % | 2.91 % |

12/31/2020 | $31,659 | $321.81 | $265.00 | $121.62 | $130.59 | 1.53 % | 1.64 % | 3.17 % |

9/30/2020 | $27,868 | $314.06 | $273.29 | $115.54 | $101.79 | 1.75 % | 2.05 % | 3.80 % |

6/30/2020 | $25,637 | $221.53 | $147.44 | $119.04 | $88.66 | 1.93 % | 2.52 % | 4.45 % |

3/31/2020 | $21,424 | $161.64 | $98.48 | $126.98 | $198.72 | 2.31 % | 3.37 % | 5.68 % |

12/31/2019 | $26,760 | $324.52 | $294.29 | $126.35 | $181.58 | 1.81 % | 2.72 % | 4.54 % |

9/30/2019 | $24,707 | $330.42 | $282.12 | $123.12 | $175.89 | 1.94 % | 3.12 % | 5.06 % |

6/28/2019 | $24,423 | $333.26 | $290.00 | $118.68 | $165.46 | 1.93 % | 3.27 % | 5.20 % |

3/29/2019 | $23,619 | $316.56 | $291.82 | $117.33 | $205.81 | 1.97 % | 3.49 % | 5.45 % |

12/31/2018 | $21,027 | $293.82 | $242.91 | $119.81 | $222.98 | 2.17 % | 3.84 % | 6.01 % |

9/30/2018 | $24,579 | $349.04 | $306.70 | $115.72 | $203.76 | 1.81 % | 2.93 % | 4.75 % |

6/30/2018 | $23,036 | $327.53 | $288.55 | $111.60 | $190.62 | 1.89 % | 2.80 % | 4.69 % |

3/29/2018 | $22,496 | $311.26 | $281.28 | $109.18 | $189.05 | 1.90 % | 2.56 % | 4.46 % |

S&P Dow Jones Indices | |||||||

S&P 500 SECTOR BUYBACKS | |||||||

SECTOR $ MILLIONS | Q1,'22 | Q4,'21 | Q1,'21 | 12MoMar,'22 | 12MoMar,'21 | 5-YEARS | 10-YEARS |

Consumer Discretionary | $28,238 | $30,889 | $15,918 | $98,873 | $29,346 | $366,831 | $764,272 |

Consumer Staples | $8,419 | $12,817 | $9,631 | $38,485 | $24,095 | $171,508 | $395,125 |

Energy | $8,552 | $7,614 | $488 | $20,755 | $947 | $85,370 | $215,954 |

Financials | $54,690 | $51,514 | $35,389 | $209,908 | $69,437 | $749,691 | $1,155,521 |

Healthcare | $41,134 | $21,840 | $20,394 | $96,898 | $53,669 | $401,902 | $766,076 |

Industrials | $24,745 | $16,268 | $13,545 | $73,474 | $26,039 | $298,727 | $616,762 |

Information Technology | $71,580 | $74,868 | $56,360 | $275,264 | $199,072 | $1,128,219 | $1,763,926 |

Materials | $7,434 | $9,244 | $4,065 | $26,555 | $7,627 | $73,330 | $139,858 |

Real Estate | $1,131 | $645 | $427 | $2,089 | $1,768 | $14,447 | $15,779 |

Communication Services | $34,069 | $43,305 | $21,781 | $139,872 | $83,226 | $301,822 | $336,612 |

Utilities | $1,017 | $1,099 | $135 | $2,423 | $3,948 | $12,039 | $19,167 |

TOTAL | $281,011 | $270,102 | $178,133 | $984,596 | $499,173 | $3,603,885 | $6,189,053 |

SECTOR BUYBACK MAKEUP % | Q1,'22 | Q4,'21 | Q1,'21 | 12MoMar,'22 | 12MoMar,'21 | 5-YEARS | 10-YEARS |

Consumer Discretionary | 10.05 % | 11.44 % | 8.94 % | 10.04 % | 5.88 % | 10.18 % | 12.35 % |

Consumer Staples | 3.00 % | 4.75 % | 5.41 % | 3.91 % | 4.83 % | 4.76 % | 6.38 % |

Energy | 3.04 % | 2.82 % | 0.27 % | 2.11 % | 0.19 % | 2.37 % | 3.49 % |

Financials | 19.46 % | 19.07 % | 19.87 % | 21.32 % | 13.91 % | 20.80 % | 18.67 % |

Healthcare | 14.64 % | 8.09 % | 11.45 % | 9.84 % | 10.75 % | 11.15 % | 12.38 % |

Industrials | 8.81 % | 6.02 % | 7.60 % | 7.46 % | 5.22 % | 8.29 % | 9.97 % |

Information Technology | 25.47 % | 27.72 % | 31.64 % | 27.96 % | 39.88 % | 31.31 % | 28.50 % |

Materials | 2.65 % | 3.42 % | 2.28 % | 2.70 % | 1.53 % | 2.03 % | 2.26 % |

Real Estate | 0.40 % | 0.24 % | 0.24 % | 0.21 % | 0.35 % | 0.40 % | 0.25 % |

Communication Services | 12.12 % | 16.03 % | 12.23 % | 14.21 % | 16.67 % | 8.37 % | 5.44 % |

Utilities | 0.36 % | 0.41 % | 0.08 % | 0.25 % | 0.79 % | 0.33 % | 0.31 % |

TOTAL | 100.00 % | 100.00 % | 100.00 % | 100.00 % | 100.00 % | 100.00 % | 100.00 % |

S&P Dow Jones Indices | ||||||||||

S&P 500 20 LARGEST Q1 2022 BUYBACKS, $ MILLIONS | ||||||||||

Company | Ticker | Sector | Q1 2022 | Q4 2021 | Q1 20221 | 12-Months | 12-Months | 5-Year | 10-Year | Indicated |

Buybacks | Buybacks | Buybacks | Mar,'22 | Mar,'21 | Buybacks | Buybacks | Dividend | |||

$ Million | $ Million | $ Million | $ Million | $ Million | $ Million | $ Million | $ Million | |||

Apple | AAPL | Information Technology | $22,961 | $23,366 | $18,847 | $92,371 | $89,665 | $375,799 | $533,335 | $15,804 |

Alphabet | GOOGL | Communication Services | $13,300 | $13,473 | $11,395 | $52,179 | $39,992 | $125,913 | $132,513 | $0 |

Meta Platforms | FB | Communication Services | $10,431 | $21,569 | $5,016 | $55,467 | $19,224 | $97,168 | $101,998 | $0 |

Microsoft | MSFT | Information Technology | $8,822 | $7,433 | $6,930 | $31,116 | $27,385 | $106,321 | $160,462 | $18,592 |

S&P Global | SPGI | Financials | $7,069 | $2 | $41 | $7,084 | $62 | $12,187 | $16,219 | $1,204 |

Amgen | AMGN | Health Care | $6,360 | $1,443 | $871 | $10,464 | $4,422 | $43,208 | $53,489 | $4,371 |

Wells Fargo | WFC | Financials | $6,018 | $6,949 | $596 | $19,878 | $2,711 | $78,291 | $116,756 | $3,886 |

Bristol-Myers Squibb | BMY | Health Care | $5,000 | $2,751 | $1,775 | $9,512 | $4,476 | $20,922 | $25,655 | $4,708 |

Lowe's Companies | LOW | Consumer Discretionary | $4,037 | $4,013 | $3,038 | $14,011 | $10,179 | $31,325 | $50,301 | $2,830 |

Morgan Stanley | MS | Financials | $3,681 | $2,847 | $2,582 | $13,174 | $5,680 | $32,297 | $42,349 | $6,202 |

Charter Communications | CHTR | Communication Services | $3,333 | $4,597 | $3,652 | $15,112 | $14,878 | $52,073 | $54,610 | $0 |

Broadcom | AVGO | Information Technology | $3,290 | $3,099 | $461 | $7,002 | $1,218 | $22,174 | $22,306 | $6,771 |

Comcast | CMCSA | Communication Services | $3,223 | $2,055 | $309 | $7,586 | $1,222 | $18,692 | $40,291 | $4,886 |

Union Pacific | UNP | Industrials | $3,183 | $1,445 | $1,347 | $9,127 | $5,234 | $31,462 | $45,275 | $3,312 |

Berkshire Hathaway | BRK.b | Financials | $3,180 | $6,869 | $6,580 | $23,661 | $30,527 | $61,143 | $61,143 | $0 |

Citigroup | C | Financials | $3,163 | $162 | $1,793 | $9,308 | $4,709 | $50,310 | $71,088 | $4,048 |

Visa | V | Information Technology | $2,952 | $4,217 | $1,719 | $12,340 | $7,395 | $43,699 | $67,769 | $2,488 |

Marathon Petroleum | MPC | Energy | $2,846 | $2,742 | $0 | $7,500 | $984 | $13,689 | $20,695 | $1,343 |

Adobe | ADBE | Information Technology | $2,666 | $1,117 | $1,341 | $5,994 | $3,940 | $17,656 | $22,187 | $0 |

Amazon.com | AMZN | Consumer Discretionary | $2,666 | $0 | $0 | $2,666 | $0 | $2,666 | $2,666 | $0 |

Top 20 | $118,181 | $110,149 | $68,293 | $405,552 | $273,903 | $1,236,995 | $1,641,107 | $80,445 | ||

S&P 500 | $281,011 | $270,102 | $123,907 | $984,596 | $499,173 | $3,603,885 | $6,189,053 | $589,388 | ||

Top 20 % of S&P 500 | 42.06 % | 40.78 % | 55.12 % | 41.19 % | 54.87 % | 34.32 % | 26.52 % | 13.65 % | ||

Gross values are not adjusted for float | ||||||||||

S&P Dow Jones Indices | ||||

S&P 500 Q1 2022 Buyback Report | ||||

SECTOR | DIVIDEND | BUYBACK | COMBINED | |

YIELD | YIELD | YIELD | ||

Consumer Discretionary | 2.28 % | 3.17 % | 5.45 % | |

Consumer Staples | 1.58 % | 2.57 % | 4.15 % | |

Energy | 2.08 % | 1.86 % | 3.93 % | |

Financials | 1.52 % | 3.41 % | 4.93 % | |

HealthCare | 2.01 % | 2.12 % | 4.13 % | |

Industrials | 1.68 % | 1.55 % | 3.23 % | |

Information Technology | 1.65 % | 3.86 % | 5.51 % | |

Materials | 1.25 % | 1.61 % | 2.86 % | |

Real Estate | 0.72 % | 0.10 % | 0.82 % | |

Communications Services | 0.75 % | 5.59 % | 6.34 % | |

Utilities | 2.19 % | 0.18 % | 2.38 % | |

S&P 500 | 1.63 % | 2.74 % | 4.36 % | |

Uses full values (unadjusted for float) | ||||

Dividends based on indicated; buybacks based on the last 12-months ending Q1,'22 | ||||

Share Count Changes | ||

(Y/Y diluted shares used for EPS) | >=4% | <=-4% |

Q1 2022 | 7.62 % | 17.64 % |

Q4 2021 | 10.06 % | 14.89 % |

Q3 2021 | 10.22 % | 7.41 % |

Q2 2021 | 11.02 % | 5.41 % |

Q1 2021 | 10.40 % | 5.80 % |

Q4 2020 | 9.02 % | 6.01 % |

Q3 2020 | 8.62 % | 9.62 % |

Q2 2020 | 8.60 % | 17.80 % |

Q1 2020 | 8.00 % | 19.60 % |

Q4 2019 | 7.63 % | 20.68 % |

Q3 2019 | 8.62 % | 22.85 % |

Q2 2019 | 7.98 % | 24.15 % |

Q1 2019 | 8.03 % | 24.90 % |

ABOUT S&P DOW JONES INDICES

S&P Dow Jones Indices is the largest global resource for essential index-based concepts, data and research, and home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial Average®. More assets are invested in products based on our indices than products based on indices from any other provider in the world. Since Charles Dow invented the first index in 1884, S&P DJI has been innovating and developing indices across the spectrum of asset classes helping to define the way investors measure and trade the markets.

S&P Dow Jones Indices is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies, and governments to make decisions with confidence. For more information, visit: www.spdji.com.

S&P DJI MEDIA CONTACTS:

April Kabahar

(+1) 917 796 3121

april.kabahar@spglobal.com

Lauren Davis

(+1) 484 269 7118

lauren.davis@spglobal.com

S&P DJI INDEX SERVICES:

Howard Silverblatt

Senior Index Analyst

(+1) 973 769 2306

howard.silverblatt@spglobal.com

SOURCE S&P Dow Jones Indices