Press Releases

Deteriorating economic circumstances set stage for an uncertain 2023 landscape

SOUTHFIELD, Mich., Dec. 21, 2022 /PRNewswire/ -- With volume for the month projected at 1.19 million units, December U.S. auto sales are estimated to translate to an estimated sales pace of below 13.0 million units (seasonally adjusted annual rate: SAAR). The SAAR reading would be the weakest monthly result since May 2022, and the underlying daily selling rate metric would be a slight step back from the trend of the preceding three months.

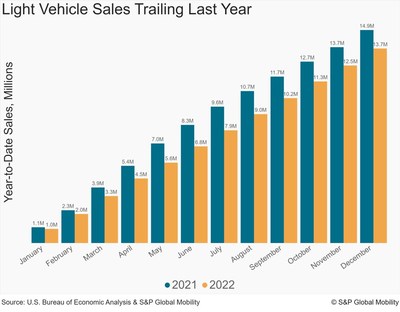

The daily selling rate metric in December is expected to decelerate mildly from the remarkably steady 44.9K per day average since August. While stubbornly sticky low levels of inventory dampened year-end clearance incentives, the backward movement in the daily selling metric could be a signal of a retrenching auto consumer. The December result will bring the full-year U.S. light vehicle sales total to 13.8 million units, an 8% decline from the CY2021 total.

U.S. Light Vehicle Sales | ||||

Dec 22 (Est) | Nov 22 | Dec 21 | ||

Total Light Vehicle | Units, NSA | 1,193,000 | 1,120,067 | 1,203,993 |

In millions, SAAR | 12.7 | 14.1 | 12.7 | |

Light Truck | In millions, SAAR | 10.1 | 11.0 | 9.9 |

Passenger Car | In millions, SAAR | 2.6 | 3.1 | 2.8 |

Source: S&P Global Mobility (Est), U.S. Bureau of Economic Analysis | ||||

"Looking back at a tumultuous year for auto demand, the December sales result reflects apparent steadiness in the market," said Chris Hopson, principal analyst at S&P Global Mobility. "Steadiness should not be misconstrued as exuberance though. Auto consumers are plagued by an uncertain economic environment, high vehicle prices, higher interest rates, and low inventory levels."

None of these issues will be resolved quickly as the market moves through 2023. The S&P Global Mobility auto outlook for next year carries a countercyclical narrative: Expected production levels will continue to increase, even as economic conditions are expected to deteriorate through the early stages of next year.

"The advancing production levels, along with reports of sustained retail order books, recovering stock of vehicles, and a fleet sector that remains starved for product, should provide some impetus to auto demand levels even as an economic recession looms," Hopson said. "We project calendar-year 2023 sales volume of 14.8 million units in the U.S., a 7% increase from the estimated 2022 tally. But even as the industry hopes to leave 2022 in the review mirror, uncertainty awaits entering the New Year." (For S&P Global Mobility's full 2023 Global outlook, click here).

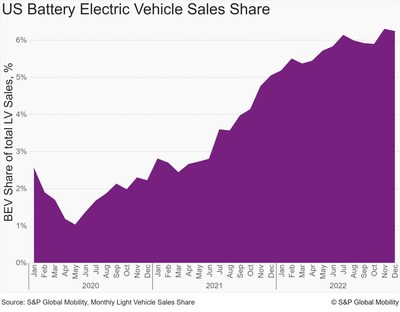

Next year will see the sustained advance of battery-electric vehicles. BEV share of new light vehicle sales in the U.S. is expected to reach 6.2% in December 2022, which would translate to a full-year share of 5.4% – a YOY volume growth estimate of approximately 260,000 units. Further electrificaton progress in 2023 will be fueled by product rollouts including the Lexus RZ, Fisker Ocean, a wave of BEV product from GM including the Chevrolet Equinox EV and Chevrolet Blazer EV, and advancing Tesla production levels. Incentives as directed by the IRA should also promote sales.

At S&P Global Mobility, we provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. We open the door to automotive innovation, revealing the buying patterns of today and helping customers plan for the emerging technologies of tomorrow.

S&P Global Mobility is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/mobility.

Media Contact:

Michelle Culver

S&P Global Mobility

248.728.7496 or 248.342.6211

Michelle.culver@spglobal.com

SOURCE S&P Global Mobility