Press Releases

Analysis finds the current sentiment level on earnings calls declined sharply year-over-year, but remains well above the pessimism seen during the COVID-19 pandemic

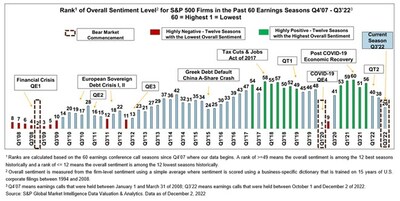

NEW YORK, Feb. 1, 2023 /PRNewswire/ -- The overall sentiment of S&P 500 firms has deteriorated for three straight earnings seasons as of Q3'22, which concluded in December. The current market conditions, however, are nowhere near the downtrends that were seen in late 2008 or during the early parts of COVID-19, according to a new white paper published by S&P Global Market Intelligence.

The white paper, Machines Signal Q4'22 Guidance Not Falling Off a Cliff, is the inaugural edition of a new quarterly series featuring natural language processing algorithms to systematically review an earnings conference call season. The first of its kind analysis leverages original frameworks that were developed by S&P Global Market Intelligence to extract sentiment, financial growth, guidance and topics of interest to demonstrate the insights that can be discovered algorithmically from textual data.

"One key takeaway is that firms' guidance for Q4'22 is not as dire as some may anticipate according to our framework. In fact, the percent of S&P 500 firms expecting top-line, bottom-line and profitability growth hover at their respective 15-year historical averages." said Frank Zhao, Senior Director, S&P Global Market Intelligence. "Another takeaway is that supply chain constraints or inflationary pressures were of waning focus for firms while the rapidly rising and elevated U.S. interest rate has gained prominence."

Key takeaways of the inaugural edition:

- Guidance Not Falling Off a Cliff: The breadth of firms that are expecting growth in their financials for Q4'22 hover at their historical averages, an encouraging sign that firms are not expecting broad-based softness (yet) as actuals tend to unfold much better than guidance.

- Interest Rate Top of Mind: Supply chain-, inflation- and pandemic-related worries were of waning focus on Q3'22 calls whereas 'rising interest rate' has taken center stage.

- Neutral Sentiment: The overall sentiment has deteriorated from highly positive to neutral in a span of three seasons, but remains well above the pessimistic depths of the two previous bear markets induced by the COVID-19 global pandemic and the 2008 housing crisis.

- Unevenness to the Financials: The number of firms citing profitability growth has been a bright spot as Q3'22 is ranked 12th best in the past 60 quarters in part due to cost control while the percent of firms citing bottom-line growth has been in an 'earnings recession' for the past three quarters in part due to rising expenses and currency headwinds.

Q4'22 S&P 500 Bank Earnings Sentiment Analysis:

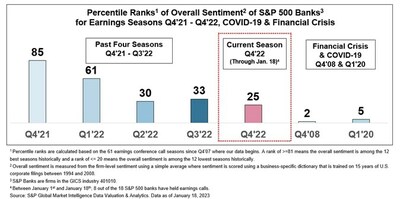

The Q4'22 season kicks off on a sour note, as sentiment continued its decline among the large banks, which announce early in the season. The overall sentiment of the S&P 500 banks has deteriorated to a percentile rank of 25, a decrease of 7 from Q3'22 season, as of January 18, 2023. The banks have kicked off the new Q4'22 earnings season on a muted note. With the exception of the COVID-19 shock, the last time S&P 500 banks had a similar level of sentiment was during the European Sovereign Debt Crisis I and II from Q4'10 to Q3'11.

To request a copy of the Machines Signal Q4'22 Guidance Not Falling Off a Cliff, please contact pressinquiries.mi@spglobal.com.

S&P Global Market Intelligence's opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Katherine Smith

S&P Global Market Intelligence

+1 781-301-9311

katherine.smith@spglobal.com

SOURCE S&P Global Market Intelligence