Press Releases

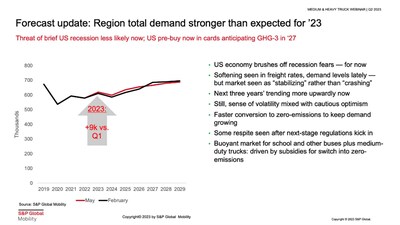

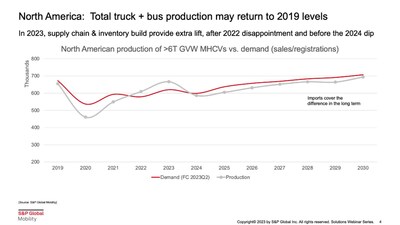

Demand is softening while production sustains in 2023, slowing into '24 - whereupon both rebound in the build-up to the GHG-3 pre-buy wave.

SOUTHFIELD, Mich., July 6, 2023 /PRNewswire/ -- Post-pandemic market corrections will flatten North American demand and growth of Class 5-8 commercial vehicles and buses in the near term, according to recent forecasts from S&P Global Mobility. Electrification will drive accelerating growth as next tier of regulations arrives in 2027.

The US economy appears to have skirted the short recession in 2023, thanks to stoic consumer spending in durable and nominal goods, coupled with the resurgence in services, travel, and restaurants – which have buoyed freight and truck activity though still being constrained by supply chain issues after the COVID-19 pandemic. A slowing-down is expected to be visible by the fourth quarter, turning into a soft-growth 2024.

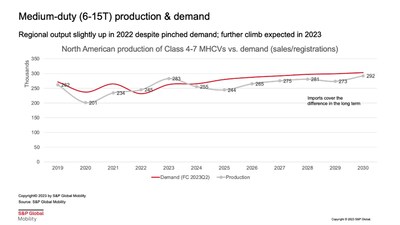

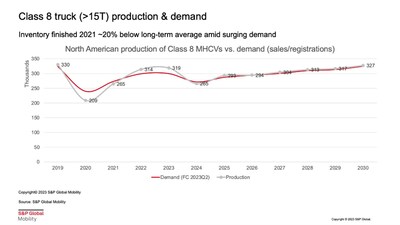

After a strong first half of 2023, there should be a moderate reduction in medium- and heavy-duty commercial vehicle and bus demand through 2024, according to S&P Global Mobility's Q2 2023 forecast update. However, the updated forecast maintains a more positive outlook for 2025 to 2026, when the truck market gears up for the next level of emissions regulations. The third tier of the 2027 greenhouse regulations, combined with the timing of the fleet replacement cycle, will likely fuel a strong wave of pre-emptive buying.

"The added cost of those tougher regulations will drive more purchase activity in the middle of the decade," said Antti Lindstrom, principal analyst for commercial vehicle forecasting at S&P Global Mobility. Furthermore, in the bus space, support measures from the public sector are driving the conversion of school buses and transit buses to zero-emission solutions, adding to this optimistic outlook.

As momentum slows, demand is estimated to dip to a low of around 505,000 units in 2024 (including buses and motorhomes), with projections indicating approximately 543,000 units by 2025. While not the primary driver, the energy transition in the trucking sector starting in California – plus about a dozen other CARB states with similar trajectories – is poised to support volume growth in 2023 and after. In addition to expected new-product updates, both established players and startup OEMs are continuing to introduce "cleaner" versions of their existing truck models such as the Freightliner eCascadia and Hino's XL8 series, not to mention PACCAR's Kenworth and Peterbilt BEV models that comply with zero-emissions standards.

There are several variations in observable market trends across different vehicle classes:

- Class 4 trucks, which were popular until the beginning of 2022, have been increasingly taken as lighter-duty applications for last-mile distribution during the pandemic. Ford's Class 4 Econoline Cutaway model accounts for nearly two-thirds of models in this segment and may see increased competition rising from the start-ups entering the fray.

- Class 5 vehicles, while facing supply chain issues, are expected to see an increase in demand following a post-pandemic pause - for example in public-sector buying.

- Class 6 trucks have gained attention due to their fuel efficiency and suitability for many commercial purposes. However, softening of the housing and construction market triggered a dip in Class 6 truck registrations.

- Class 7 trucks have been on a decline in popularity due to their licensing requirements and higher costs vs. Class 6, in addition to the recent preference of OEMs and customers for trucks that bracket this segment.

- After a stronger 2022 where OEMs continued to focus on Class 8 trucks amid supply chain bottlenecks, we expect tractor-truck registrations to remain flat this year before a dip in 2024, and a modest upward trajectory picks up again starting in 2025.

- Not yet recovered to pre-pandemic levels, bus and motor home demand is projected to climb significantly in the current year and remaining at a similar level in 2024, supported by a rebound in school bus purchases. Growth is to resume in 2025, with motor homes and other bus types expected to provide the additional lift then.

Regardless of weight class, the more stringent environmental compliance will be the key driver in demand and production of all vehicle types. Upcoming regulations, specifically the proposed greenhouse gas emissions standards by the Environmental Protection Agency are forcing traditional OEMs to re-evaluate their manufacturing and investment strategies and prompting a potentially rapid shift from internal combustion engine (ICE) products to electrified vehicles.

These laws, in conjunction with the continued push for more aggressive decarbonization efforts by states like California with its Advanced Clean Fleet regulation, are acting as the key catalyst in the transformation of powertrain technologies. However, the transition to the adoption of hydrogen and fuel cell technologies remains limited by cost, infrastructure, and availability issues. This suggests battery-powered electrification as the go-to strategy will be pushed further into the midterm until those issues can be resolved – notwithstanding the recharging network for BEV trucks, which remains to be built.

Disruptor brands like Tesla and Nikola will accelerate this transition for their part and help strengthen the US as the region's epicenter of production. As for the legacy brands, despite supply chain and labor issues, their Class 4-8 production rates for the North America region reached and even slightly exceeded the average build rates of 2019 by the end of 2022. While some production targets are still not being achieved, inventories continue being rebuilt – setting the stage for potential growth later.

"Inventory figures of Class 4-7 trucks - which represent about half the market - remain below long-term averages, which is one reason why we think production has some upward potential," said Andrej Divis, executive director of global truck research at S&P Global Mobility.

Overall, present demand is still strong, owing to the muted risk of recession compared to the previous two quarters, combined with surprisingly resilient consumer activity. Production is expected to sustain its surge in the short term, while remaining constrained by supply chain and labor issues, before levelling off and even declining in 2024.

About S&P Global Mobility

At S&P Global Mobility, we provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. We open the door to automotive innovation, revealing the buying patterns of today and helping customers plan for the emerging technologies of tomorrow.

S&P Global Mobility is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/mobility.

Media Contact:

Michelle Culver

S&P Global Mobility

248.728.7496 or 248.342.6211

Michelle.Culver@spglobal.com

SOURCE S&P Global Mobility