Press Releases

LONDON and NEW YORK, Nov. 20, 2023 /PRNewswire/ -- Just days away from this year's United Nations Conference of Parties (COP) 28 meeting, what's clear is that that global energy systems will need to achieve historic and unprecedented levels of innovation to redress climate change and meet the world's energy needs. COP28 will deliver the first completed global stocktake of the world's progress toward meeting climate goals. Key findings include an implementation gap, with countries falling short of their targets, and an emissions ambition gap recognizing that current targets fall far short of the needed levels of commitments to reach Paris goals.

Saugata Saha, president, S&P Global Commodity Insights, said, "Given the competing geopolitical, economic, and financial pressures – and increasingly domestic-oriented policy directions – a key success at COP28 will be all countries taking part and remaining around the negotiating table. A good result beyond participation would be the build-up of trust, cooperation on sharing technologies, opening channels for needed capital flows, and bridging the North-South divide to solve the Energy Trilemma of affordability, security, and sustainability."

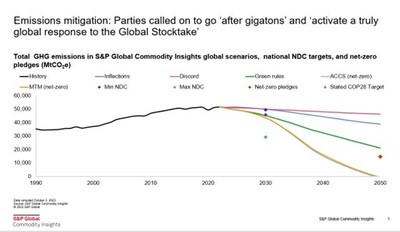

To help understand the challenges to reaching the emissions targets, experts at S&P Global Commodity Insights have developed three plausible scenarios and two net-zero cases extending to 2050 and featuring in-depth coverage of trends in oil, gas, coal, power, renewables, emissions and hydrogen markets at the global, regional and country levels:

- S&P Global Commodity Insights' base case – or 'Inflections' scenario, projects transformative change that would result in a reduction in fossil fuels' share of total energy demand from the present 80% to 58% and greenhouse gas (GHG) emissions dropping 25% from today's levels by 2050. This brings global warming to about 2.4 degrees Celsius, which is short of what is needed to achieve Paris Agreement goals.

- An aggressive decarbonization – or 'Green Rules' scenario includes revolutionary transformation toward a sustainable low-carbon economy but does not reach net-zero emissions until 2085, and sees average global temperatures rise of 1.7 degrees Celsius by 2100. It envisions more efficient energy use and fossil fuels dropping to less than 40% of total energy demand and total emissions falling nearly 60% from today's levels.

- A 'Discord' scenario foresees a world fractured by successive crises that cause long-term damage to the geopolitical and macroeconomic environment, with rising costs creating uncertainty, hindering investment, and causing market volatility. This scenario expects higher reliance on fossil energy with significant GHG emissions and a warming by 3 degrees Celsius by 2100.

The results of S&P Global Commodity Insights' scenarios work indicate that the world still needs to innovate toward commercially viable technologies to bring net-zero within reach. The chart below provides a sense of the emissions paths of the different scenarios (including the two net zero cases) and the shortfalls as compared to NDC goals and net zero targets. However, what happens at COP can impact the trajectories. Watch for signposts across a number of key themes.

S&P Global Commodity Insights Eight Key Themes to Watch at COP28:

- Emissions mitigation targets are off track. The first global stocktake report found that the current emissions reduction targets that countries have established, as part of their commitments under the Paris Agreement, are insufficient to meet the overarching goal of the Agreement to ideally limit the global temperature rise to 1.5 degrees Celsius above pre-industrial levels. According to S&P Global Commodity Insights' global stocktake analysis, the current ambitions would result in GHG emissions levels almost double those that are needed to keep the world on the Intergovernmental Panel on Climate Change's 1.5-degree-Celsius trajectory. Whether countries respond with more aggressive plans and conviction will be key.

- Language around a phase out of fossil fuels to be a key negotiating point. The European Union has announced that it will be bringing a proposal to phase out unabated fossil fuel use to COP28. If countries agree to such a pledge, expect debate regarding the exact language used. Key terms to watch will be "phase down" versus "phase out" and "unabated" versus "all."

- Success to hinge on negotiations around financing from developed nations. In 2009, developed nations pledged $100 billion a year to developing nations for climate mitigation and adaptation, to be met in 2020. That goal was not met until 2023 and is well below what developing nations have indicated is necessary for them to meet their most aggressive climate-related targets. Negotiators will work this year on developing a post-2025 finance goal, but continued disagreement between developing and developed nations will put the ability and willingness of developing nations to scale up climate mitigation efforts at risk.

- Expect a focus on industry-led solutions and low-carbon innovation. One of the United Arab Emirates' key goals for COP28 is a tripling of renewable energy capacity by 2030 globally, a target in line with the S&P Global Commodity Insights Aggressive Decarbonization scenario but out of range in the base case Inflections scenario. Methane is likely to be another key action area as the COP28 president-designate has called on the oil and gas industry to "eliminate methane emissions by 2030." Technology around carbon management and carbon capture is expected to feature in discussions, with hydrogen solutions expected to attract significant attention.

- Developed and developing nation differences slow progress on Loss & Damage and adaptation. After an historic agreement at last year's COP27 on developing a funding mechanism for loss and damage, developed and developing nations have not agreed on the location, legal status, fund contributors, or allocation of the fund's resources. This has brought the operationalization of the fund into question. In early November, negotiators struck a tentative deal on the structure of the fund, which could be proposed and adopted at COP28. However, the proposal contains contentious elements, which have yet to be resolved, slowed further by a divide between nations about the use of targets and metrics.

- Opportunity for further progress on operationalizing Paris Agreement Article 6. COP26 saw the finalization of the Paris Agreement Article 6 rulebook for international funding and accounting of carbon emissions reductions across borders. This next step is necessary to drive greater reductions at lower costs to achieve and go beyond nationally determined contributions (NDC) targets. The Article 6.4 Supervisory Board is tasked with addressing technical details (e.g., methodologies for crediting and inclusion of carbon removals), and recommendations from this Board are expected to be presented for formal adoption at COP28. With the Voluntary Carbon Market under increased scrutiny, policymakers want to ensure that the UN rules avoid unnecessary pitfalls.

- Reform of multilateral development banks and the role of private sector investment in financing the energy sector transition remains a key topic of discussion. As multilateral development banks undergo a period of structural reform, questions remain regarding their role in financing the energy transition in developing nations. Project developers will watch to see if these banks will be able to change their mandates to drive additional investment to the developing nations and whether reform can create a structure to crowd-in private sector investment.

- COP has become a proxy for other issues and relations restoration. Using climate as a proxy, nations in recent years have used these meetings to establish positions and leverage negotiations on other topics. For example, climate action has been an area that the United States and China have found common ground even when publicly at odds on other geopolitical issues. However, using these negotiations as a proxy for other geopolitical issues can also slow action on climate.

At this link, find Unraveling Uncertainty: 2023 Scenarios and Net-Zero Cases – the energy transition is in flux.

S&P Global Commodity Insights executives, experts and news teams will be on the ground at COP28 in Dubai, United Arab Emirates, assisting hosts and attendees' needs for essential intelligence, insights and data. For more on COP28 and the energy transition, visit the Markets Insights section of the website, or the dedicated Energy Transition Insights page.

Media Contacts:

Americas: Kathleen Tanzy + 1 917-331-4607, kathleen.tanzy@spglobal.com

EMEA: Paul Sandell + 44 (0)7816 180039, paul.sandell@spglobal.com

Asia: Melissa Tan + 65-6597-6241, melissa.tan@spglobal.com

About S&P Global Commodity Insights

At S&P Global Commodity Insights, our complete view of global energy and commodity markets enables our customers to make decisions with conviction and create long-term, sustainable value.

We're a trusted connector that brings together thought leaders, market participants, governments, and regulators and we create solutions that lead to progress. Vital to navigating commodity markets, our coverage includes oil and gas, power, chemicals, metals, agriculture, shipping and energy transition. Platts® products and services, including leading benchmark price assessments in the physical commodity markets, are offered through S&P Global Commodity Insights. S&P Global Commodity Insights maintains clear structural and operational separation between its price assessment activities and the other activities carried out by S&P Global Commodity Insights and the other business divisions of S&P Global.

S&P Global Commodity Insights is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information visit https://www.spglobal.com/commodityinsights.

SOURCE S&P Global Commodity Insights