Press Releases

S&P Global Mobility projects that US auto sales in March will crest over 1.4 million units – just the second time since May 2021 that monthly volume has reached this level.

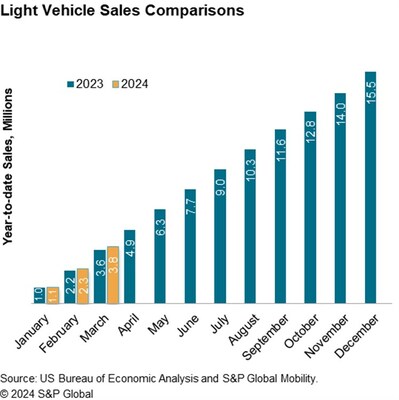

SOUTHFIELD, Mich., March 26, 2024 /PRNewswire/ -- With volume for the month projected at 1.47 million units, March 2024 U.S. auto sales are estimated to translate to an estimated sales pace of 15.8 million units (seasonally adjusted annual rate: SAAR). This would bring the SAAR average in the first quarter of the year to a level of 15.5 million units. While progress from a year-ago reading of 15 million units, it would reflect a step down from the 15.7 million unit reading of the fourth quarter of 2023, reflective of the volatile nature of the current auto demand environment.

"With inventory growing, incentives rising, and quarter-end sales targets to be met, March sales volume will be relatively positive, rising to over 1.4 million units for just the second time in the past 34 months," said Chris Hopson, principal analyst at S&P Global Mobility. "However, since the second quarter of 2023, the pace of sales has been in a prolonged holding period, given the current purchase environment facing auto consumers. High interest rates, slowly receding vehicle prices and uncertain economic conditions continue to push against any consistent upshift for demand levels."

Regarding inventory trends, Matt Trommer, associate director of Market Reporting at S&P Global Mobility said, "At the beginning of March, available dealer advertised inventories were up to 2.62 million units, an increase of 56% over last year and up 5% compared to the beginning of February 2023. Model-year (MY) 2024 vehicles represented 84% of that inventory, so pockets of MY2023 vehicles remain, setting up the potential for additional spring clearance activity."

The S&P Global Mobility US auto outlook for 2024 reflects sustained, but more moderate growth levels for light vehicle sales. Production levels are expected to continue to develop, especially early in the year as some automakers look to continue to restock in wake of production shutdowns late in 2023 and decent December 2023 sales volume.

"Advancing production levels set the stage for incentives and inventory to continue to develop, potentially enticing new vehicle buyers who remain on the sidelines due to higher interest rates, but it will be a bumpy ride and month-to-month sales volatility is likely," said Hopson. "S&P Global Mobility projects calendar-year 2024 light vehicle sales volume of 15.96 million units, a 3% increase from the 2023 tally."

U.S. Light Vehicle Sales | ||||

Mar 24 (Est) | Feb 24 | Mar 23 | ||

Total Light Vehicle | Units, NSA | 1,469,600 | 1,247,516 | 1,374,992 |

In millions, SAAR | 15.8 | 15.8 | 14.9 | |

Light Truck | In millions, SAAR | 12.8 | 12.7 | 11.9 |

Passenger Car | In millions, SAAR | 3.0 | 3.1 | 3.0 |

Source: S&P Global Mobility (Est), U.S. Bureau of Economic Analysis | ||||

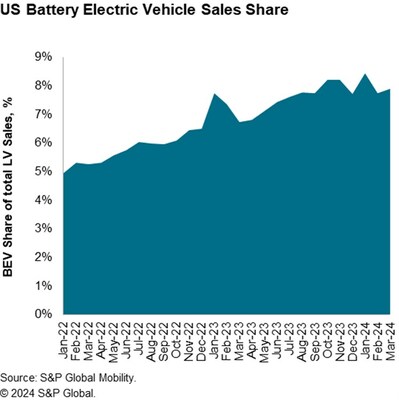

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. March BEV share is expected to reach 8%, similar to the month prior reading as automakers, dealers and consumers continue to digest the changes to IRA Federal tax credits to begin the new year. BEV share is expected to advance over the next several periods, pending the roll outs of vehicles such as the Chevrolet Equinox EV, Honda Prologue and Fiat 500e, all scheduled for market introductions over the first half of 2024.

About S&P Global Mobility

At S&P Global Mobility, we provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. We open the door to automotive innovation, revealing the buying patterns of today and helping customers plan for the emerging technologies of tomorrow.

S&P Global Mobility is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/mobility.

Media Contact:

Michelle Culver

S&P Global Mobility

248.728.7496 or 248.342.6211

Michelle.culver@spglobal.com

SOURCE S&P Global Mobility