Press Releases

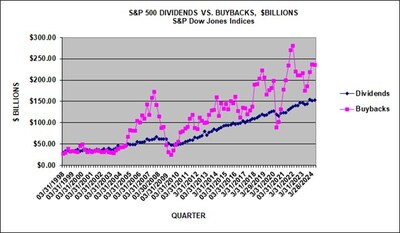

- S&P 500 Q2 2024 buybacks were $235.9 billion, down 0.4% from Q1 2024's $236.8 billion and up 34.9% from Q2 2023's $174.9 billion

- The 12-month June 2024 expenditure of $877.5 billion was up 8.0% from the prior 12-month expenditure of $812.5 billion

- Information Technology increased spending by 19.3%, as Health Care and Communication Services reduced their spending by 26.2% and 23.6%

- The net buyback 1% tax reduced Q2 2024 operating earnings by 0.45% and As Reported GAAP by 0.49%

NEW YORK, Oct. 7, 2024 /PRNewswire/ -- S&P Dow Jones Indices (S&P DJI) today announced the preliminary S&P 500® stock buybacks or share repurchases data for Q2 2024.

Historical data on S&P 500 buybacks is available at www.spdji.com/indices/equity/sp-500.

Key Takeaways:

- Q2 2024 share repurchases were $235.9 billion, down 0.4% from Q1 2024's $236.8 billion expenditure, and up 34.9% from Q2 2023's $174.9 billion.

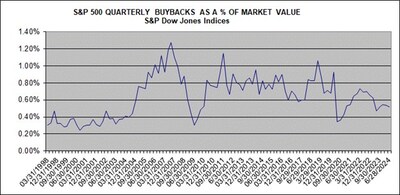

- For the 12-months ending June 2024, buybacks were $877.5 billion, up from $812.5 billion for the prior 12-month June 2023 period; the 12-month peak was in June 2022 with $1.005 trillion.

- 324 companies reported buybacks of at least $5 million for the quarter, down from 352 in Q1 2024 and up from 304 in Q2 2023; 373 companies did some buybacks for the quarter, down from 380 in Q1 2024 and up from 367 in Q2 2023; 419 companies did some buybacks in the last 12-month period, down from 425 in the prior 12-month period.

- Buybacks remained top heavy, as concentration increased, with the top 20 S&P 500 companies accounting for 52.3% of Q2 2024 buybacks, up from Q1 2024's 50.9%, and above the historical average of 47.5% and the pre-COVID historical average of 44.5%.

- 12.7% of companies reduced share counts used for earnings per share (EPS) by at least 4% year-over-year, down from Q1 2023's 13.3% and down from Q2 2023's 16.3%; for Q2 2024 167 issues increased their shares used for EPS over Q1 2024, and 261 reduced them.

- S&P 500 Q2 2024 dividends increased 1.2% to $153.4 billion from the prior Q1 2024 $151.6 billion and were 7.1% greater than the $143.2 billion in Q2 2023. For the 12-month's ending June 2024, dividends set a record $603.3 billion payments, up 4.7% on an aggregate basis from the prior 12-month June 2023's $576.4 billion.

- Total shareholders return of buybacks and dividends increased to $389.3 billion in Q2 2024, up 0.2% from Q1 2024's $388.4 billion and up 22.4% from Q2 2023's $318.1 billion. Total shareholder returns for the 12-months ending June 2024 increased 6.6% to $1.481 trillion from the prior 12-month periods $1.389 trillion.

- The 1% tax on net buybacks, which started in 2023, reduced the Q2 2024 S&P 500 operating earnings by 0.45%, down from Q1 2024's 0.47% impact. It also reduced As Reported GAAP earnings by 0.49%, down from the prior 0.54%. For the 12-month June 2024 period, the 1% tax on net buybacks reduced earnings by 0.44% for operating and 0.49% for As Reported.

"Companies continue to spend on buybacks, with the last 12-months posting an 8% increase in expenditures. However, since the market was up 23%, companies got fewer shares for buybacks as prices have escalated. The impact has been a reduced upward impact on EPS and less buying support for stocks. Given more employee options are in the money, with the spread for companies to negate them via buybacks costing more, companies may need to stock-up on shares, especially if options holders have concerns over higher 2025 tax rates or companies anticipate a higher buyback tax for 2025. For the remainder of 2024 we see a broader pickup in buyback activity, as companies with strong cashflows continue to dominate," said Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices.

"With the recent interest rate reduction, and the market's current expectations for additional cuts this year, companies may be more willing to increase their buyback expenditures. This is amidst continued uncertainty over geopolitical and domestic economic issues. Any potential buyback tax increase was not seen as being implemented before at least mid-year 2025. Top-tier cash-flow issues are seen as continuing their buybacks and positively impacting their EPS for the remainder of this year."

1% Buyback Excise Tax:

The 1% excise tax on net buybacks reduced Q2 2024 operating earnings by 0.45%, down from Q1 2024's 0.47% and up from the 0.34% for Q2 2023. The 12-month impact was 0.44%, up from the 12-month June 2023's 42% and down from the proforma June 2022 rate of 0.53%. The tax on As Reported GAAP earnings impact decreased to 0.49%, from Q1 2024's 0.54% and up from Q2 2023's 0.38%. The 12-month impact was 0.49%, flat from June 2023's 0.49% and down from the proforma June 2022's 0.57%.

Silverblatt added: "The 1% tax remains a manageable expense and has not impacted overall buybacks at this point. However, given the initial 1% buyback tax had bipartisan support and remains an attractive cash generator, there is an expectation that some increase or potential change to the type of buybacks that are taxed will remain on the table following the election cycle. Given the current corporate sensitivity to costs, a buyback tax rate of 2% to 2.5% was seen as impacting both buybacks and the EPS impact of share-count-reduction (which is already at a lower level due to higher stock prices). This is because some of the expenditures may shift from buybacks to dividends. However, any shift would not be on a-dollar-for-dollar basis as dividends remain a long-term pure cash-flow item which must be incorporated into corporate budgets."

Q2 2024 GICS® Sector Analysis:

Information Technology maintained its lead in buybacks, as it increased expenditure the most (in percentage and dollar), representing 29.0% of all buybacks for the quarter. Q2 2024 expenditures increased 19.3% to $68.4 billion, compared to Q1 2024's $57.3 billion, and was up 45.0% from Q2 2023's $47.1 billion expenditure. For the 12-months ending June 2024, the sector increased its expenditure 9.0% to $230.5 billion, representing 26.3% of all S&P 500 buybacks, compared to $211.5 billion spent in the prior 12-month period ending June 2023, which represented 26.0% of all buybacks.

Financials increased buybacks by 5.1% for Q2 2024 as it collectively spent $45.3 billion on buybacks, accounting for 19.2% of all S&P 500 buybacks. This was up for the quarter compared to Q1 2024's expenditure of $43.1 billion, and up 38.3% from Q2 2023's $32.7 billion. For the 12-month June 2024 period, Financials spent $147.1 billion, up from $125.2 billion for the prior 12-month period.

Healthcare decreased its Q2 2024 expenditure by 26.2%, spending $18.8 billion, compared to the Q1 2024 expenditure of $25.5 billion, and was up 40.4% from the Q2 2023 $13.4 billion expenditure. For the 12-months ending June 2024, the sector spent $72.5 billion, down from the prior period's expenditure of $81.1 billion.

Communication Services decreased their spending in Q2 2024 by 23.6% to $34.5 billion, down from the prior $45.1 billion and up 35.9% from the Q2 2023 expenditure of $25.4 billion.

Energy increased their spending by 17.7% to $16.7 billion from Q1 2024's $14.2 billion and was 8.7% lower than the $18.3 billion spent in Q2 2023.

Issues:

The five issues with the highest total buybacks for Q2 2024 were:

- Apple (AAPL): continued to dominate the issue level buybacks, as it again spent the most of any issue with its Q2 2024 expenditure. It spent a record amount, ranking as the highest in S&P 500 history. For the quarter, the company spent $28.8 billion, up from Q1 2024's $23.5 billion (the 7th largest in index history). Apple holds 18 of the top 20 record quarters (Meta Platforms holds #15 and QUALCOMM holds #17). For the 12-months ending June 2024, Apple spent $96.3 billion on buybacks, up from the prior 12-month period's $86.4 billion. Over the five-year period, Apple has spent $440 billion and $687 billion over the ten-year period.

- Alphabet (GOOG/L): $15.684 billion for Q2 2024, a tick lower than $15.696 billion in Q1 2024; the 12-month expenditure was $63.4 billion versus the prior expenditure of $60.3 billion.

- Meta Platforms (META): $9.5 billion for Q2 2024, down from $18.2 billion in Q1 2024; the 12-month expenditure was $41.5 billion versus $27.8 billion.

- NVIDA (NVDA): $8.8 billion for Q2 2024, down from $9.5 billion in Q1 2024; the 12-month expenditure was $26.4 billion versus $9.6 billion.

- Wells Fargo (WFC): $6.023 billion for Q2 2024, a tick up from $6.001 billion in Q1 2024; the 12-month expenditure was $15.8 billion versus 2022's $8.0 billion.

For more information about S&P Dow Jones Indices, please visit https://www.spglobal.com/spdji/en/.

S&P Dow Jones Indices | |||

S&P 500 proforma net buyback tax impact | |||

TAX | TAX % OF | TAX % OF | |

$ BILLIONS | OPERATING | AS REPORTED | |

12 Mo Jun,'24 | $8.09 | 0.44 % | 0.49 % |

12 Mo Jun,'23 | $7.39 | 0.42 % | 0.49 % |

Q2 2024 | $2.20 | 0.45 % | 0.49 % |

Q1 2024 | $2.18 | 0.47 % | 0.54 % |

Q4 2023 | $2.02 | 0.44 % | 0.50 % |

Q3 2023 | $1.70 | 0.39 % | 0.42 % |

Q2 2023 | $1.55 | 0.34 % | 0.38 % |

Q1 2023 | $1.98 | 0.45 % | 0.49 % |

2023 | $7.47 | 0.40 % | 0.45 % |

2022 proforma | $8.47 | 0.51 % | 0.58 % |

2021 proforma | $7.93 | 0.45 % | 0.47 % |

S&P Dow Jones Indices | ||||||||

S&P 500, $ U.S. BILLIONS | (preliminary in bold) | |||||||

PERIOD | MARKET | OPERATING | AS REPORTED | DIVIDEND & | ||||

VALUE | EARNINGS | EARNINGS | DIVIDENDS | BUYBACKS | DIVIDEND | BUYBACK | BUYBACK | |

$ BILLIONS | $ BILLIONS | $ BILLIONS | $ BILLIONS | $ BILLIONS | YIELD | YIELD | YIELD | |

12 Mo Jun,'24 | $45,843 | $1,838.58 | $1,643.84 | $603.29 | $877.46 | 1.32 % | 1.91 % | 3.23 % |

12 Mo Jun,'23 | $37,162 | $1,741.50 | $1,514.77 | $576.37 | $812.49 | 1.55 % | 2.19 % | 3.74 % |

2023 | $40,039 | $1,787.36 | $1,610.73 | $588.23 | $795.16 | 1.47 % | 1.99 % | 3.46 % |

2022 | $32,133 | $1,656.66 | $1,453.43 | $564.57 | $922.68 | 1.76 % | 2.87 % | 4.63 % |

2021 | $40,356 | $1,762.75 | $1,675.22 | $511.23 | $881.72 | 1.27 % | 2.18 % | 3.45 % |

2020 | $31,659 | $1,019.04 | $784.21 | $483.18 | $519.76 | 1.53 % | 1.64 % | 3.17 % |

2019 | $26,760 | $1,304.76 | $1,158.22 | $485.48 | $728.74 | 1.81 % | 2.72 % | 4.54 % |

2018 | $21,027 | $1,281.66 | $1,119.43 | $456.31 | $806.41 | 2.17 % | 3.84 % | 6.01 % |

6/28/2024 Prelim. | $45,843 | $489.95 | $445.96 | $153.41 | $235.93 | 1.32 % | 1.91 % | 3.23 % |

3/28/2024 | $44,078 | $458.28 | $397.38 | $151.61 | $236.82 | 1.35 % | 1.85 % | 3.20 % |

12/31/2023 | $40,039 | $452.44 | $401.16 | $154.10 | $219.09 | 1.47 % | 1.99 % | 3.46 % |

9/30/2023 | $35,938 | $437.90 | $399.35 | $144.18 | $185.62 | 1.61 % | 2.19 % | 3.81 % |

6/30/2023 | $37,162 | $457.93 | $405.66 | $143.20 | $174.92 | 1.55 % | 2.19 % | 3.74 % |

3/31/2023 | $34,342 | $439.08 | $404.57 | $146.76 | $215.53 | 1.67 % | 2.50 % | 4.17 % |

12/31/2022 | $32,133 | $421.55 | $331.50 | $146.07 | $211.19 | 1.76 % | 2.87 % | 4.63 % |

9/30/2022 | $30,119 | $422.94 | $373.04 | $140.34 | $210.84 | 1.83 % | 3.26 % | 5.09 % |

6/30/2022 | $31,903 | $395.02 | $360.21 | $140.56 | $219.64 | 1.70 % | 3.15 % | 4.85 % |

3/31/2022 | $38,288 | $417.16 | $388.68 | $137.60 | $281.01 | 1.37 % | 2.57 % | 3.94 % |

12/31/2021 | $40,356 | $480.35 | $456.72 | $133.90 | $270.10 | 1.27 % | 2.18 % | 3.45 % |

9/30/2021 | $36,538 | $441.26 | $420.64 | $130.04 | $234.64 | 1.37 % | 2.03 % | 3.40 % |

6/30/2021 | $36,325 | $439.95 | $409.02 | $123.38 | $198.84 | 1.33 % | 1.68 % | 3.01 % |

S&P Dow Jones Indices | |||||||

S&P 500 SECTOR BUYBACKS | |||||||

SECTOR $ MILLIONS | Q2,'24 | Q1,'24 | Q2,'23 | 12MoJun,'24 | 12MoJun,'23 | 5-YEARS | 10-YEARS |

Consumer Discretionary | $18,156 | $16,059 | $17,664 | $81,741 | $74,326 | $363,002 | $792,466 |

Consumer Staples | $10,466 | $11,998 | $4,265 | $36,519 | $28,897 | $160,874 | $372,172 |

Energy | $16,669 | $14,157 | $18,253 | $63,119 | $79,404 | $191,374 | $283,516 |

Financials | $45,286 | $43,087 | $32,742 | $147,094 | $125,157 | $717,470 | $1,311,381 |

Healthcare | $18,825 | $25,522 | $13,408 | $72,495 | $81,148 | $378,266 | $786,697 |

Industrials | $16,829 | $16,854 | $12,585 | $75,081 | $66,340 | $303,903 | $660,406 |

Information Technology | $68,356 | $57,290 | $47,134 | $230,483 | $211,481 | $1,149,069 | $2,014,353 |

Materials | $5,192 | $5,241 | $3,154 | $18,674 | $19,152 | $93,802 | $161,032 |

Real Estate | $728 | $620 | $71 | $2,444 | $2,119 | $12,134 | $21,469 |

Communication Services | $34,478 | $45,126 | $25,371 | $146,339 | $122,620 | $566,214 | $607,543 |

Utilities | $940 | $868 | $279 | $3,467 | $1,844 | $13,432 | $21,949 |

TOTAL | $235,926 | $236,823 | $174,924 | $877,456 | $812,488 | $3,949,541 | $7,032,983 |

SECTOR BUYBACK MAKEUP % | Q2,'24 | Q1,'24 | Q2,'23 | 12MoJun,'24 | 12MoJun,'23 | 5-YEARS | 10-YEARS |

Consumer Discretionary | 7.70 % | 6.78 % | 10.10 % | 9.32 % | 9.15 % | 9.19 % | 11.27 % |

Consumer Staples | 4.44 % | 5.07 % | 2.44 % | 4.16 % | 3.56 % | 4.07 % | 5.29 % |

Energy | 7.07 % | 5.98 % | 10.43 % | 7.19 % | 9.77 % | 4.85 % | 4.03 % |

Financials | 19.20 % | 18.19 % | 18.72 % | 16.76 % | 15.40 % | 18.17 % | 18.65 % |

Healthcare | 7.98 % | 10.78 % | 7.66 % | 8.26 % | 9.99 % | 9.58 % | 11.19 % |

Industrials | 7.13 % | 7.12 % | 7.19 % | 8.56 % | 8.17 % | 7.69 % | 9.39 % |

Information Technology | 28.97 % | 24.19 % | 26.95 % | 26.27 % | 26.03 % | 29.09 % | 28.64 % |

Materials | 2.20 % | 2.21 % | 1.80 % | 2.13 % | 2.36 % | 2.38 % | 2.29 % |

Real Estate | 0.31 % | 0.26 % | 0.04 % | 0.28 % | 0.26 % | 0.31 % | 0.31 % |

Communication Services | 14.61 % | 19.05 % | 14.50 % | 16.68 % | 15.09 % | 14.34 % | 8.64 % |

Utilities | 0.40 % | 0.37 % | 0.16 % | 0.40 % | 0.23 % | 0.34 % | 0.31 % |

TOTAL | 100.00 % | 100.00 % | 100.00 % | 100.00 % | 100.00 % | 100.00 % | 100.00 % |

S&P Dow Jones Indices | ||||||||||

S&P 500 20 LARGEST Q2 2024 BUYBACKS, $ MILLIONS | ||||||||||

Company | Ticker | Sector | Q2 2024 | Q1 2024 | Q2 2023 | 12-Months | 12-Months | 5-Year | 10-Year | Indicated |

Buybacks | Buybacks | Buybacks | Jun,'24 | Jun,'23 | Buybacks | Buybacks | Dividend | |||

$ Million | $ Million | $ Million | $ Million | $ Million | $ Million | $ Million | $ Million | |||

Apple | AAPL | Information Technology | $28,810 | $23,489 | $19,863 | $96,344 | $86,402 | $439,789 | $687,270 | $14,414 |

Alphabet | GOOGL | Communication Services | $15,684 | $15,696 | $14,969 | $63,358 | $60,325 | $245,397 | $271,393 | $4,699 |

Meta Platforms | META | Communication Services | $9,507 | $18,170 | $2,590 | $41,499 | $27,849 | $149,564 | $173,826 | $4,383 |

NVIDIA | NVDA | Information Technology | $8,795 | $9,492 | $3,739 | $26,357 | $9,582 | $45,253 | $51,462 | $984 |

Wells Fargo | WFC | Financials | $6,012 | $6,001 | $4,005 | $15,843 | $8,032 | $63,457 | $127,454 | $5,578 |

JPMorgan | JPM | Financials | $5,336 | $2,832 | $2,477 | $12,825 | $5,167 | $59,779 | $123,170 | $14,358 |

Exxon Mobil | XOM | Energy | $5,326 | $3,011 | $4,340 | $17,405 | $17,849 | $41,973 | $55,104 | $17,047 |

Visa | V | Financials | $4,535 | $2,767 | $3,048 | $14,810 | $10,581 | $54,220 | $86,083 | $3,274 |

Danaher | DHR | Health Care | $4,530 | $0 | $0 | $4,530 | $0 | $4,530 | $4,530 | $712 |

Salesforce | CRM | Information Technology | $4,335 | $2,133 | $1,949 | $10,085 | $8,003 | $18,088 | $18,088 | $1,554 |

Microsoft | MSFT | Information Technology | $4,210 | $4,213 | $5,704 | $17,254 | $22,245 | $122,548 | $195,012 | $22,297 |

Goldman Sachs Group | GS | Financials | $3,574 | $2,752 | $810 | $8,832 | $7,162 | $30,352 | $60,833 | $3,870 |

Bank of America | BAC | Financials | $3,535 | $2,500 | $550 | $7,846 | $4,213 | $63,209 | $116,373 | $7,076 |

Monster Beverage | MNST | Consumer Staples | $3,114 | $120 | $56 | $3,803 | $565 | $5,758 | $10,753 | $0 |

Chevron | CVX | Energy | $2,930 | $2,891 | $4,340 | $12,552 | $15,061 | $33,588 | $38,433 | $11,175 |

Marathon Petroleum | MPC | Energy | $2,896 | $2,218 | $3,068 | $10,438 | $10,156 | $28,159 | $36,848 | $1,163 |

Mastercard | MA | Financials | $2,643 | $2,162 | $2,419 | $8,553 | $9,343 | $36,277 | $56,599 | $2,167 |

Adobe | ADBE | Information Technology | $2,635 | $2,222 | $1,103 | $7,179 | $5,768 | $26,877 | $34,660 | $0 |

Medtronic plc | MDT | Health Care | $2,492 | $1,628 | $152 | $4,478 | $461 | $9,464 | $22,074 | $3,718 |

T-Mobile US | TMUS | Communication Services | $2,403 | $3,786 | $3,661 | $11,093 | $11,495 | $43,146 | $45,410 | $1,341 |

Top 20 | $123,302 | $108,083 | $78,843 | $395,084 | $320,259 | $1,521,428 | $2,215,376 | $119,809 | ||

S&P 500 | $235,926 | $236,823 | $174,924 | $877,456 | $812,488 | $3,949,541 | $7,032,984 | $622,599 | ||

Top 20 % of S&P 500 | 52.26 % | 45.64 % | 45.07 % | 45.03 % | 39.42 % | 38.52 % | 31.50 % | 19.24 % | ||

Gross values are not adjusted for float | ||||||||||

S&P Dow Jones Indices | |||

S&P 500 Q2 2024 Buyback Report | |||

SECTOR | DIVIDEND | BUYBACK | COMBINED |

YIELD | YIELD | YIELD | |

Consumer Discretionary | 0.79 % | 1.82 % | 2.61 % |

Consumer Staples | 2.45 % | 1.35 % | 3.80 % |

Energy | 3.19 % | 3.83 % | 7.02 % |

Financials | 1.59 % | 2.37 % | 3.96 % |

HealthCare | 1.56 % | 1.26 % | 2.82 % |

Industrials | 1.41 % | 1.91 % | 3.31 % |

Information Technology | 0.64 % | 1.58 % | 2.22 % |

Materials | 1.81 % | 1.78 % | 3.60 % |

Real Estate | 3.26 % | 0.22 % | 3.48 % |

Communications Services | 1.13 % | 4.41 % | 5.54 % |

Utilities | 3.03 % | 0.36 % | 3.40 % |

S&P 500 | 1.35 % | 1.91 % | 3.26 % |

Uses full values (unadjusted for float) | |||

Dividends based on indicated; buybacks based on the last 12-months ending Q2,'24 | |||

Share Count Changes | ||

(Y/Y diluted shares used for EPS) | >=4% | <=-4% |

Q2 2024 | 5.04 % | 12.70 % |

Q1 2024 | 4.62 % | 13.25 % |

Q4 2023 | 3.81 % | 12.63 % |

Q3 2023 | 4.60 % | 13.80 % |

Q2 2023 | 4.22 % | 16.27 % |

Q1 2023 | 4.02 % | 18.47 % |

Q4 2022 | 5.01 % | 19.44 % |

Q3 2022 | 7.21 % | 21.24 % |

Q2 2022 | 8.42 % | 19.84 % |

Q1 2022 | 7.62 % | 17.64 % |

Q4 2021 | 10.06 % | 14.89 % |

Q3 2021 | 10.22 % | 7.41 % |

Q2 2021 | 11.02 % | 5.41 % |

ABOUT S&P DOW JONES INDICES

S&P Dow Jones Indices is the largest global resource for essential index-based concepts, data and research, and home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial Average®. More assets are invested in products based on our indices than products based on indices from any other provider in the world. Since Charles Dow invented the first index in 1884, S&P Dow Jones Indices has been innovating and developing indices across the spectrum of asset classes helping to define the way investors measure and trade the markets.

S&P Dow Jones Indices is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies, and governments to make decisions with confidence. For more information, visit: https://www.spglobal.com/spdji/en/.

S&P Dow Jones Indices Media Contacts:

April Kabahar

(+1) 917 796 3121

april.kabahar@spglobal.com

Alyssa Augustyn

(+1) 773 919 4732

alyssa.augustyn@spglobal.com

S&P Dow Jones Indices Index Services:

Howard Silverblatt

Senior Index Analyst

(+1) 973 769 2306

howard.silverblatt@spglobal.com

SOURCE S&P Dow Jones Indices