Press Releases

NEW YORK, Oct. 29, 2024 /PRNewswire/ -- Trends for global M&A and IPO activity continue to diverge, according to S&P Global Market Intelligence's newly released Q3 2024 Global M&A and Equity Offerings Report. The number of global M&A deal announcements increased for the second consecutive quarter, while global equity issuance slowed significantly in the third quarter.

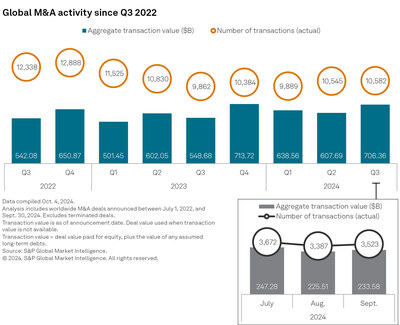

The number of global M&A announcements ticked up slightly, 0.36% quarter-over-quarter in the third quarter, but the increase marked the second consecutive quarter of quarterly growth for the first time since the third and fourth quarters of 2020. On a year-over-year basis, global M&A announcements increased 7.3%, ending a streak of 10-straight quarters of global announcements decreasing.

"Signs of recovery continue to dot the dealmaking landscape, and additional positive indicators in the fourth quarter should create a substantial amount of optimism for 2025 as further rate reductions from the Federal Reserve tend to lower the cost of acquisition financing," said Joe Mantone, lead author of the report at S&P Global Market Intelligence. "However, after a strong start to the third quarter, equity issuance was sidetracked after a spike in volatility, and issuers have been slow to return. Even if volatility is more subdued in the fourth quarter, the calendar presents some near-term challenges for IPO pipelines with deals expected to pause around the US elections and year-end holidays. A lack of fourth-quarter IPOs would only add to pent-up demand for the transactions."

Key highlights from the Q3 2024 Global M&A and Equity Offerings Report include:

- Stock market volatility led to the total value of equity issuance falling nearly 33% to $65.63 billion from second quarter levels and nearly 21% from the year-ago period.

- Global equity issuance volume fell to 788, down 241 from the second quarter of 2024 and down 198 from the third quarter of 2023.

- The number of global M&A announcements increased quarter over quarter for the second straight period, the first time that has happened since the third and fourth quarters of 2020.

- The total value of global M&A deals increased 29.1% year over year to $708.74 billion in the third quarter.

The quarterly report provides an overview of global M&A and equity issuance trends, offering insights into the sectors and geographies that are seeing the most activity. It also focuses on deals with the highest valuations and strategies larger players pursue that underscore trends occurring throughout an industry. S&P Global Market Intelligence has produced the quarterly, global M&A and equity offering report since the first quarter of 2018.

To request a copy of the Q3 2024 Global M&A and Equity Offerings Report, please contact press.mi@spglobal.com.

S&P Global Market Intelligence's opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Kate Smith

S&P Global Market Intelligence

+1 781 301 9311

Katherine.smith@spglobal.com or press.mi@spglobal.com

SOURCE S&P Global Market Intelligence